Intro

Limitation of traditional cryptocurrencies as a medium of exchange due to its high volatility resulted in introduction of new class of crypto called stablecoin. Stablecoins aim to achieve both the characteristics of existing cryptocurrencies (e.g. Bitcoin) and traditional financial assets such as USD and gold. Stablecoins are known for its price stability by *collateralizing* various assets. There are four major types of stablecoins, classified by its collateralized asset:

- Fiat-backed stablecoin

- Commodity-backed stablecoin

- Cryptocurrency-backed stablecoin

- Algorithmic stablecoin (Seigniorage stablecoin)

While most stablecoins maintain price stability via collateralizing “safe assets”, it is not quite clear how crypto-backed tokens operate.

If the underlying asset is volatile, shouldn’t the stablecoin itself be volatile as well?

In this article, we will take a look at how DAI token, a crypto-backed stablecoin developed by MakerDAO, maintains price stability through its own unique design.

MakerDAO

The MakerDAO is a decentralized platform for lending DAI token by accepting crypto collateral with a fixed amount of fee.

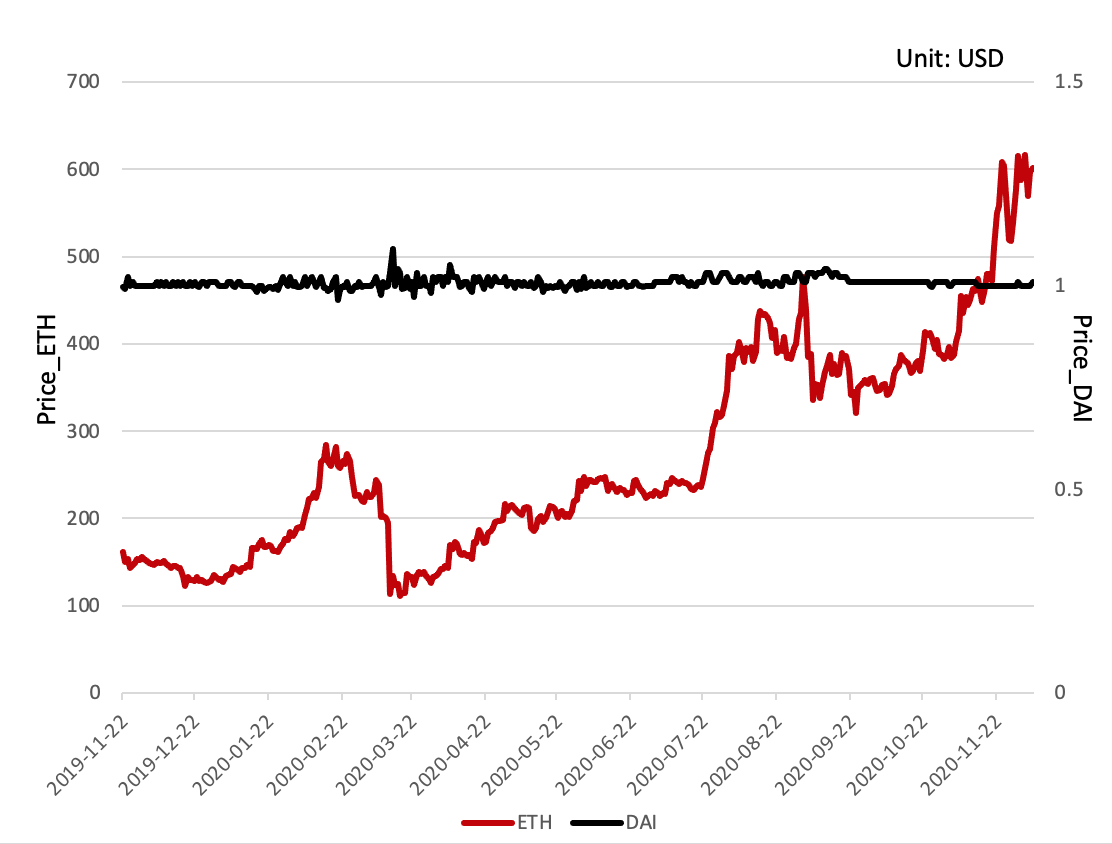

Crypto-backed tokens distinguish from other stablecoins such as Tether USDT. Majority of asset-backed stablecoins are designed so that a single entity takes control of the collateral, requiring trust of the centralized authority. Acknowledging this issue, the MakerDAO organization developed a fully decentralized stablecoin called DAI. DAI token is collateralized by Ethereum (but now accepts multiple types of crypto as collateral) but its price is soft-pegged to $1 USD. Figure 1 shows the price history of DAI and Ethereum over the period of one year. While the price of Ethereum shows extreme volatility over the period, price of DAI is quite close to a dollar with small variance.

Maker is a smart contract platform on Ethereum that backs and stabilizes the value of DAI through a dynamic system of Collateralized Debt Positions (CDPs), autonomous feedback mechanisms, and appropriately incentivized external actors.

In order to understand how DAI tokens maintain stability despite of extreme volatility of ETH, we must understand how the token is generated. MakerDAO now accepts multiple types of crypto as collateral, but here we will assume that ETH is the only available collateral.

1. Creating CDP vault and depositing collateral

First, the user creates a “vault” that locks the collateral in a smart contract called Collateralized Debt Position (CDP). Here, the minimum collateral ratio (aka “liquidation ratio”) is 150%. This means that the value of collateral must be at least 1.5x of the value of borrowed DAI.

For example, let’s say the Alice wants to borrow 1,000 DAI ($1,000) and the current market price of Ethereum is $100. Then, the minimum amount of Ethereum that Alice must collateralize is $1,500 worth of Ethereum, which is equivalent to 15 ETH.

If the market price of ETH decrease so that the collateral-to-debt ratio falls under 150% (i.e., falls below the liquidation ratio), the vault automatically goes into clearing stage where the collateralized ETH is liquidated to cover all or part of the debt; it is the borrower’s responsibility to keep the collateral rate above 150% in order to avoid any loss and penalty fee.

2. Generate DAI from CDP

3. Paying down the debt and Stability Fee

4. Withdrawing collateral and closing the CDP

Luniverse 'Trace' Service Launching Event!

Stability Mechanism of DAI

We will now look at how MakerDAO operates when the price of DAI deviates from the peg. Here, the “price” refers to the market price of DAI traded in the secondary market. In the Maker Protocol, there are “Keepers”, who are market participants that help maintain DAI in its Target Price ($1). The general idea is that keepers are be incentivized to take advantage of the arbitrage opportunity by buying/selling DAI tokens in the market, constantly adjusting the supply and demand curve. Here, we assume that the market is rational, and it is the price of DAI that only changes during the time period.

Case 1 : price of DAI falls under $1

Case 2 : price of DAI goes above $1