Financial

Blockchain Financial Infrastructure

There’s a wide variety of possibilities that blockchain opens for financial infrastructure. Especially, the blockchain technology is expected to enhance access to financial infrastructure for two billion people around the world, especially those without bank accounts. 70% of the population of Southeast Asia being unbanked, blockchain can be the solution to bring them as new Tech-Fin customers with stablecoins.

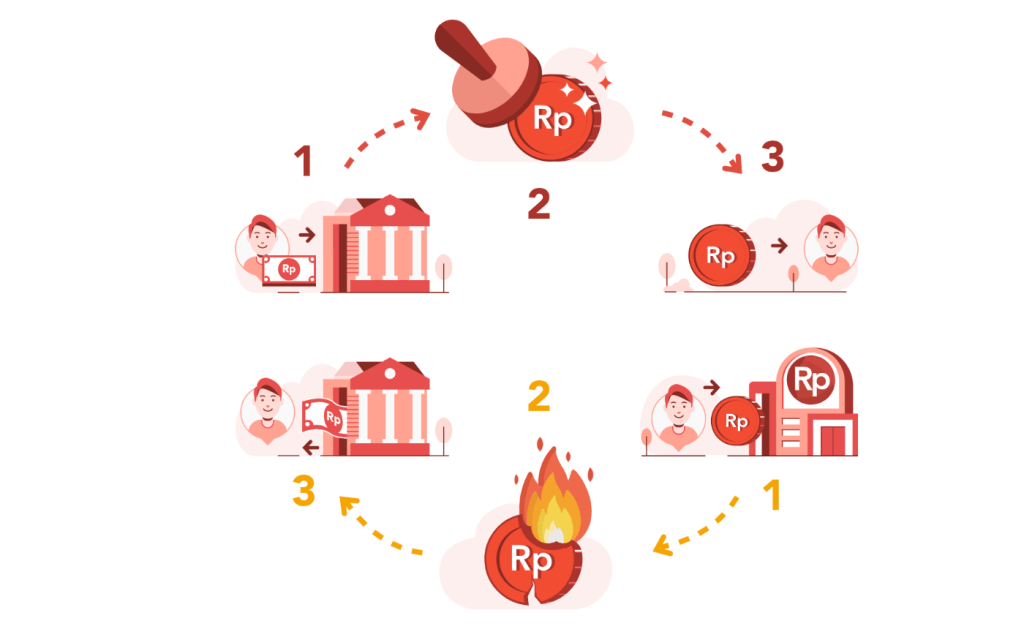

Digital Payment

The need for simpler, faster, yet safer payments is increasing worldwide. Traditional payment systems involve many intermediaries, which lead to an inevitable increase in costs, processing time, and administrative costs. Blockchain-based payments can be a safe and cost-effective alternative, especially in countries where payment systems are not yet advanced. Even in the countries with highly developed infrastructure, they can utilize blockchain in areas where payment details can be transparently disclosed and build trust among participants.